Overall Situation After the Legal Proceedings:

Following the conclusion of the legal case where Ripple was fined over $100 million, the market has reacted largely neutrally to the news. A significant price increase, as some investors had hoped for, did not materialize. Instead, XRP has entered a consolidation phase characterized by low volatility and uncertainty. This analysis will provide detailed short-term, mid-term, and long-term forecasts for XRP, incorporating the Extended Ratio Fan and Elliott Wave Theory.

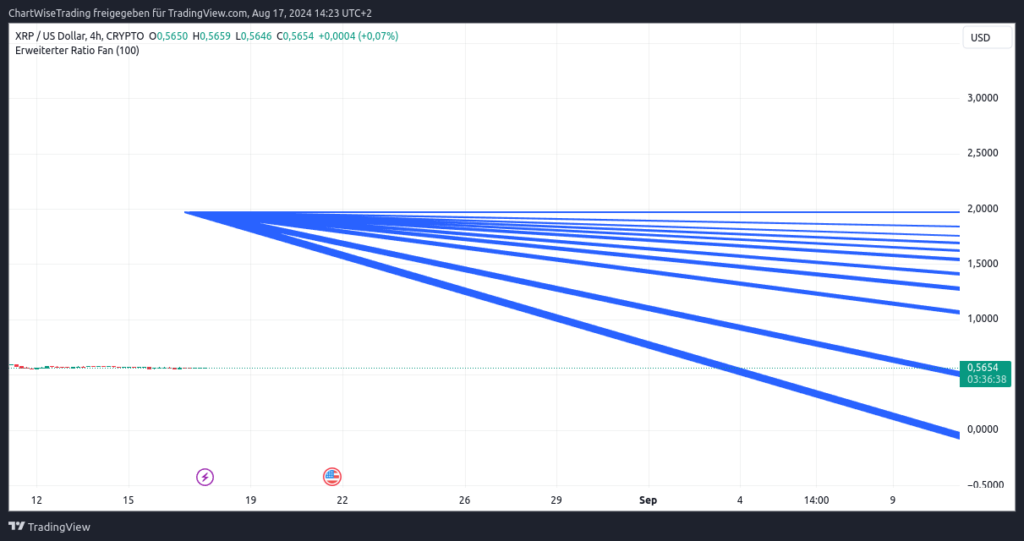

Short-Term Forecast (4-Hour Chart):

- Extended Ratio Fan:

- The 4-hour chart shows that XRP is currently trading below the lower lines of the Extended Ratio Fan. These lines represent potential resistance and support levels that could impact the current and future price trajectory. The steep downward slope of the Ratio Fan lines indicates a continued downtrend. The current price action below most of the fan lines suggests that XRP is under significant short-term downward pressure, making it difficult to overcome this trend.

- Elliott Wave Analysis:

- According to Elliott Wave Theory, the current price movement can be interpreted as part of a larger corrective wave. XRP might be in the final Wave 5 of an overarching corrective structure. This wave typically represents the final selling pressure before a recovery or trend reversal. The movement could indicate a significant correction, meaning XRP still faces short-term downside risks before a bottom is established.

Forecast:

- Realistically Conservative: XRP is likely to continue trading within a narrow range between $0.55 and $0.57. However, there is a risk that the price could fall below the $0.54 mark if selling pressure persists. A test of the $0.53 support is possible before stabilization occurs.

- Optimistic: If XRP manages to break through the $0.57 resistance level, it could lead to a short-term rise towards $0.60. This would require breaking through the lower lines of the Ratio Fan, signaling a recovery and a potential short-term reversal of the downtrend.

- Extremely Optimistic: In the best-case scenario, a sudden bullish impulse could push XRP up to $0.65. This would represent a significant move and could be supported by a strong recovery in the overall crypto market or positive fundamental news. Such a scenario would involve breaking through multiple Ratio Fan lines, indicating a strong trend reversal.

Mid-Term Forecast (Daily Chart):

- Extended Ratio Fan:

- The daily chart shows a broader range of possible price developments according to the Extended Ratio Fan. The lines suggest that XRP faces significant mid-term resistance, particularly around the $0.60 and $0.65 levels. The price is currently in a range bounded by several Ratio Fan lines, indicating a consolidating phase. A breakout above these lines could signal a bullish development, while a drop below the lower lines could lead to further downtrends.

- Elliott Wave Analysis:

- On a daily basis, XRP could be in an overarching Wave C of a larger corrective movement. This Wave C often represents the final corrective phase before the overarching trend reverses. If this corrective wave finds its bottom, it could be the starting point for a new upward movement. However, the current market structure suggests that Wave C may not be complete, indicating further downward movement before a sustainable recovery begins.

Forecast:

- Realistically Conservative: XRP is likely to continue trading within a corridor between $0.54 and $0.60. A drop to $0.50 is possible if the $0.54 support does not hold. Consolidation may continue until clear signals of a direction change emerge.

- Optimistic: If XRP breaks above the $0.60 level, it could be a positive signal for the market, potentially leading to a rise to $0.70. This upward trend would require breaking through key Ratio Fan lines and completing the current Wave C.

- Extremely Optimistic: In an extremely bullish scenario, XRP could even rise to $0.80. This would indicate strong market sentiment and possibly the beginning of a new overarching upward movement. Such a rise would only be possible with a breakthrough of several critical resistance lines in the Ratio Fan and would mark a clear reversal of the previous downtrend.

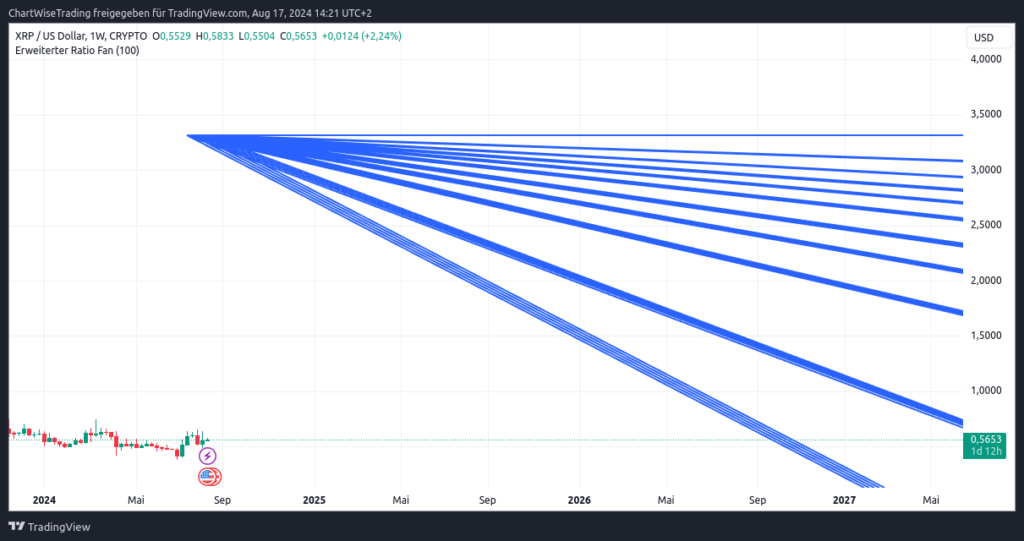

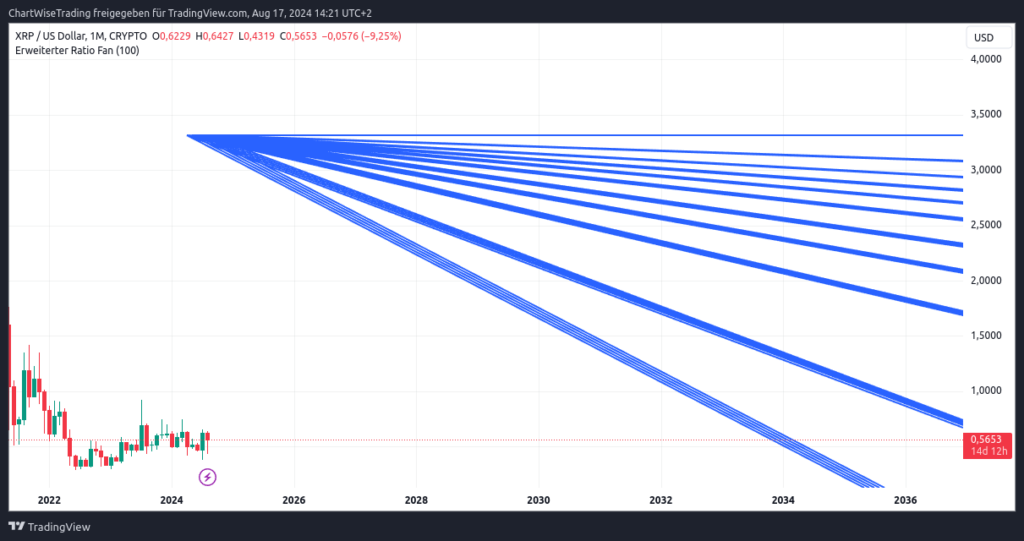

Long-Term Forecast (Weekly and Monthly Chart):

- Extended Ratio Fan:

- The Extended Ratio Fan on the long-term charts (weekly and monthly) shows a variety of possible price targets. These range from further declines to significant increases, depending on how XRP handles the resistances in the higher time frames. The price is currently near the lower lines of the Ratio Fan, indicating that the downtrend remains intact. However, a breakthrough above the upper lines of the Ratio Fan could signal the beginning of a new long-term uptrend.

- Elliott Wave Analysis:

- On the weekly and monthly charts, XRP might be in the final waves of a very large corrective structure. These could be part of a broader cycle that, once completed, could lead to a multi-year upward movement. The current wave structure suggests that XRP is nearing the end of a prolonged correction, potentially setting a stable foundation for recovery in the mid-term.

Forecast:

- Realistically Conservative: XRP could remain in a range between $0.50 and $0.70 in the long term until a clear trend reversal is established. A sustained rise above $0.70 could mark the beginning of a new upward movement but remains unlikely for now.

- Optimistic: A breakthrough above $0.70 could lead XRP to the $1.00 range in the long term. This increase would require significant market momentum and the completion of the current correction phase. Such a scenario could mark the start of a new overarching upward movement supported by positive market conditions and fundamental developments.

- Extremely Optimistic: In an extremely bullish scenario, XRP could rise to $1.50 or even higher in the long term. This would indicate a complete reversal of the current downtrend and could be fueled by widespread adoption of Ripple technologies, regulatory clarity, or a general recovery in the crypto market. Such an increase would involve breaking through the highest lines of the Ratio Fan and signal a strong, long-term rally.

Conclusion:

The current market situation for XRP remains uncertain despite the conclusion of the legal proceedings. The market has largely priced in the news, and there is currently a lack of clear bullish catalysts to drive the price higher. Technical indicators, particularly the Extended Ratio Fan and Elliott Wave Analysis, suggest a phase of consolidation in which XRP could experience further downward movements before a potential recovery sets in.

Key Levels:

- Support: $0.50 (long-term), $0.54 (short to mid-term)

- Resistance: $0.60 (short to mid-term), $0.70 (long-term)

In the coming weeks and months, it will be crucial to see if XRP can overcome the key resistance levels to signal a sustainable recovery. A decline below the critical support levels could lead to further downward movements, while a breakthrough above the resistance levels could open up the potential for a new upward movement. In the long term, XRP remains a risky but potentially rewarding investment, especially if the project succeeds in further establishing its technology and overcoming regulatory hurdles.

Disclaimer: The information provided in this analysis is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments are highly volatile and speculative, and any financial decisions should be made based on thorough research and consultation with a qualified financial advisor. The projections and scenarios discussed are based on technical analysis and past market performance, which are not guarantees of future results. Always invest what you can afford to lose and be aware of the risks involved.

Falls du noch kein Kunde einer CryptoBörse bist, oder eine suchst mit den geringsten Handelsgebühren:

🌟 Entdecke die Zukunft des Tradings mit Bitget! 🌟

Wenn du auf der Suche nach einer einzigartigen Trading-Plattform bist, die dir sowohl Sicherheit als auch spannende Möglichkeiten bietet, dann ist Bitget genau das Richtige für dich. Als weltweit fünftgrößte Börse für Futures-Trading (laut CoinGecko) setzt Bitget neue Maßstäbe in Sachen Krypto-Trading.

Warum Bitget?

- 💰 Sicherheit für dein Vermögen: Mit einem Fonds von 400 Milliarden Dollar garantiert Bitget den Schutz deiner Kryptowährungen.

- 📈 Hohe Liquidität: Tägliche Handelsvolumina von 5 bis 8 Milliarden Dollar sorgen für genügend Liquidität und reibungslose Trades.

- 🔥 Maximale Hebelwirkung: Nutze Futures-Kontrakte mit einem Hebel von bis zu x125, um dein Trading-Potenzial voll auszuschöpfen.

- 🌍 Nr. 1 im Copy Trading: Profitiere von der Expertise der besten Trader weltweit und kopiere deren Strategien einfach und bequem.

- 🎟️ Exklusive Launchpad-Zugänge: Erhalte Tickets für spannende Projekte, indem du nur 50$ in beliebiger Kryptowährung hältst.

- 🚀 Der BGB Token: Nutze das Potenzial des Bitget Tokens (BGB), der noch stark unterbewertet ist und großes Wachstumspotenzial bietet.

- ⚽ Top-Partnerschaften: Unterstützt von Juventus Turin und Lionel Messi – Bitget verbindet Krypto mit den größten Namen im Sport.

Deine Vorteile mit diesem Link:

- 💸 Bis zu 8.000 $ Bonus: Reduziere deine Gebühren oder sichere deine Positionen mit einem attraktiven Bonus.

- 🏆 Exklusive Trading-Turniere und Events: Nimm an spannenden Wettbewerben und Airdrops teil, die nur für dich zugänglich sind.

- 👩💼 Premium-Kundenservice: Genieße einen exklusiven und schnellen Support, der dir bei allen Fragen zur Seite steht.

Verpasse nicht die Chance, Teil der Bitget-Community zu werden und von diesen unschlagbaren Vorteilen zu profitieren!

🔗 Hier geht’s los: Dein persönlicher Link

(Dieser Text enthält einen Affiliate-Link, über den ich eine Provision erhalte, wenn du dich registrierst und handelst.)